Capital Projects (Penny) Sales Tax Referendum

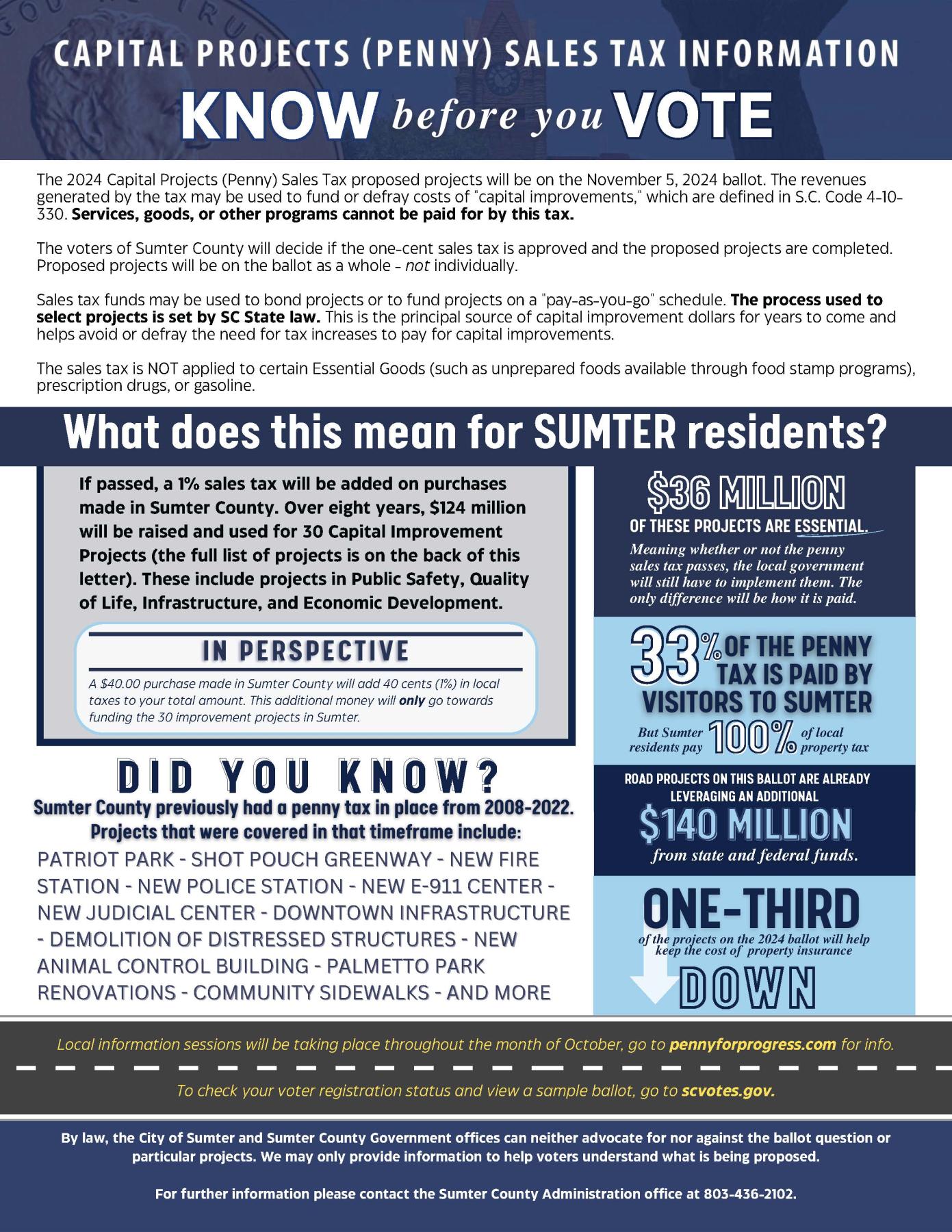

This post contains general information regarding the 2024 Capital Projects (commonly called "Penny" or "Penny for Progress") Sales Tax proposed projects that will be on the November 5, 2024 ballot. The revenues generated by the tax may be used to fund or defray costs of "capital improvements," which are defined in S.C. Code 4-10-330.

What does "Capital Projects" mean? A capital improvement is adding a permanent structural change or restoring some aspect of a property that will either enhance the property's overall value, prolong its useful life, or adapt it to new uses. By law, services, goods, or other programs cannot be paid for by this tax.

SC Code Section 4-10-330. The purpose for which the proceeds of the tax are to be used:

(a) highways, roads, streets, bridges, and public parking garages and related facilities;

(b) courthouses, administration buildings, civic centers, hospitals, emergency medical facilities, police stations, fire stations, jails, correctional facilities, detention facilities, libraries, coliseums, educational facilities under the direction of an area commission for technical education, or any combination of these projects;

(c) cultural, recreational, or historic facilities, or any combination of these facilities;

(d) water, sewer, or water and sewer projects;

(e) flood control projects and stormwater management facilities;

(f) beach access and beach renourishment;

(g) dredging, dewatering, and constructing spoil sites; disposing of spoil materials and other matters directly related to the act of dredging;

(h) jointly operated projects of the county, a municipality, special purpose district, and school district, or any combination of those entities, for the projects delineated in subitems (a) through (g) of this item;

(i) any combination of the projects described in subitems (a) through (h) of this item;

The voters of Sumter County will decide if the one-cent sales tax is approved and the proposed projects are completed. Proposed projects will be on the ballot as a whole - not individually - meaning all projects move forward with a "yes" vote or none with a "no" vote.

Sales tax funds may be used to bond projects or to fund projects on a "pay-as-you-go" schedule. The process used to select projects is set by SC State law. This is the principal source of capital improvement dollars for years to come and helps avoid or defray the need for property tax increases to pay for capital improvements.

The sales tax is not applied to certain Essential Goods (such as unprepared foods available through food stamp programs), prescription drugs, or gasoline. For more on what is exempt, click here.

By law, the City of Sumter and Sumter County Government offices can neither advocate for nor against the ballot question or particular projects. We may only provide information to help voters understand what is being proposed.

Local information sessions will be taking place throughout the month of October, go to pennyforprogress.com for info.

For further information, please contact the Sumter County Administration office at 803-436-2102.

Helpful Links:

- Click here to view a sample Sumter County ballot (PDF).

- Click here to check your voter registration status and view your sample ballot.

![]() Check Your Registration: Ensure your voter registration is up-to-date.

Check Your Registration: Ensure your voter registration is up-to-date.![]() Learn About the Candidates and Issues: Research what's on your ballot.

Learn About the Candidates and Issues: Research what's on your ballot.![]() Plan Your Vote: Decide whether you'll vote early, absentee, or on Election Day.

Plan Your Vote: Decide whether you'll vote early, absentee, or on Election Day.![]() Know Your Polling Location: Verify your polling place and its accessibility.

Know Your Polling Location: Verify your polling place and its accessibility.